Real Estate Absorption Rates in 2015 for SWFL

Why are real estate absorption rates so important when evaluating a real estate market? Starting with a definition of absorption rates as it applies to real estate, the absorption rate is the number of months it would take to sell the currently listed homes in the market. As simple as it may sound, it’s still an important concept used by real estate experts to help predict home prices and sales activity going forward.

Here is a fictional example to illustrate how absorption rate is calculated:

- In a market area, the previous six months report of home sales showed 38,235 homes sold.

- So, 38,235 homes divided by 6 months yields 6,373 homes sold per month.

- There are currently 28,145 homes listed for sale in this market. We divide this number by 6,373 and find there is currently a 4.42-month supply of homes for sale in this market. At the current rate, with none withdrawn and none added, it would take 4.42 months to sell them all.

One comparison made to help in anticipating market activity and home price action is looking back at historic absorption rate numbers for the market. Let’s say that this particular market in the example has seen several 6-month periods in the recent past with inventories running between 5 and 6 months of homes for sale, a slower rate of absorption. This speeding up of sales, which gives us a faster 4.42-month absorption rate, could mean prices are increasing or will be increasing shortly.

Essentially, the absorption rate is a method to determine how fast homes are selling in a given area, and weighs supply and demand of current housing inventory on the market. A declining figure indicates the inventory is decreasing as more homes are being sold than are coming onto the market. A rising figure implies there are more homes coming onto the market than there are buyers willing to buy at the market prices. A month’s supply between 5 and 7 months is typically indicative of a stable market.

Information on the 2015 absorption rates and pending ratios for Bonita Springs, Estero, Naples and Fort Myers/Fort Myers Beach are now available through the Matrix Multiple Listing Service (MLS). Let’s take a look at each market.

Real Estate Absorption Rates for 2015 in SWFL

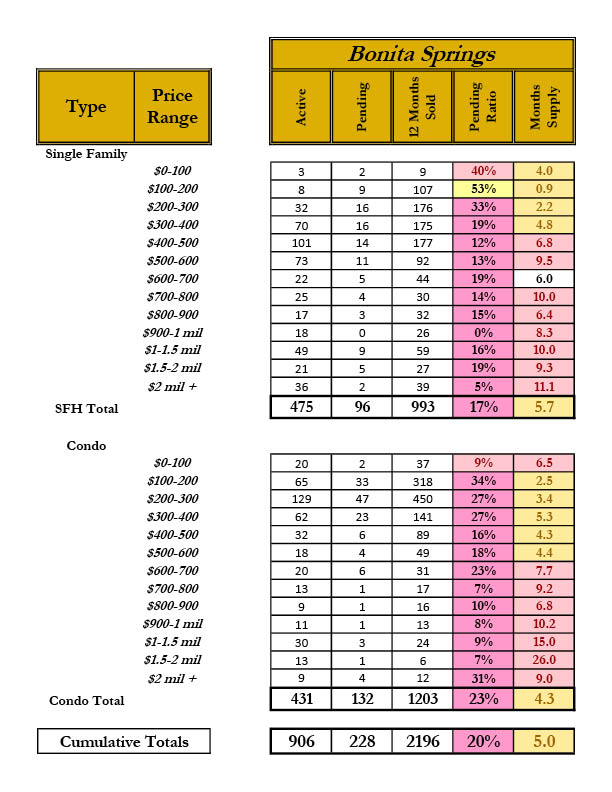

Bonita Springs

Single-family homes in Bonita Springs saw 475 active listings, 96 pending sales, 993 sales made in the past 12 months, a pending ratio of 17 percent, and a 5.7 month’s supply of inventory. For condominiums in Bonita Springs, there were 431 active listings, 132 pending sales, 1,203 sales made in the past 12 months, a pending ratio of 23 percent, and 4.3 month’s supply of inventory. Adding up the total figures for Bonita Springs, there were 906 active listings, 228 pending sales, 2,196 sales within the past 12 months, a pending ratio of 20 percent, and 5 month’s supply of inventory. The overall pending ratio of 20 percent in the Bonita Springs market indicates that the market was stable and geared toward the seller’s advantage overall in 2015.

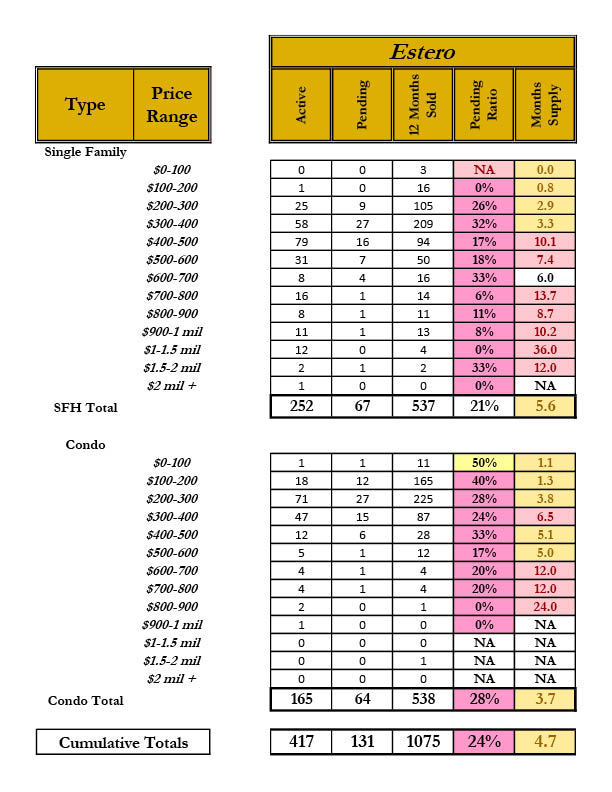

Estero

In Estero, the single-family home category had 252 active listings, 67 pending sales, and 537 sales over the past 12 months, a 21 percent pending ratio, and an inventory supply of 5.6 months. Condominiums in Estero saw 165 active listings, 64 pending sales, 538 sales made over the past 12 months, a 28 percent pending ratio, and an inventory supply of 3.7 months. Combining the figures for single-family homes and condominiums, Estero had 417 active listings, 131 pending sales, 1,075 sales made in the last 12 months, a 24 percent pending ratio, and an inventory supply of 4.7 months. Estero’s overall pending ratio of 20 percent and a month’s supply of less than 5 months indicates a seller’s market and increased prices in 2015.

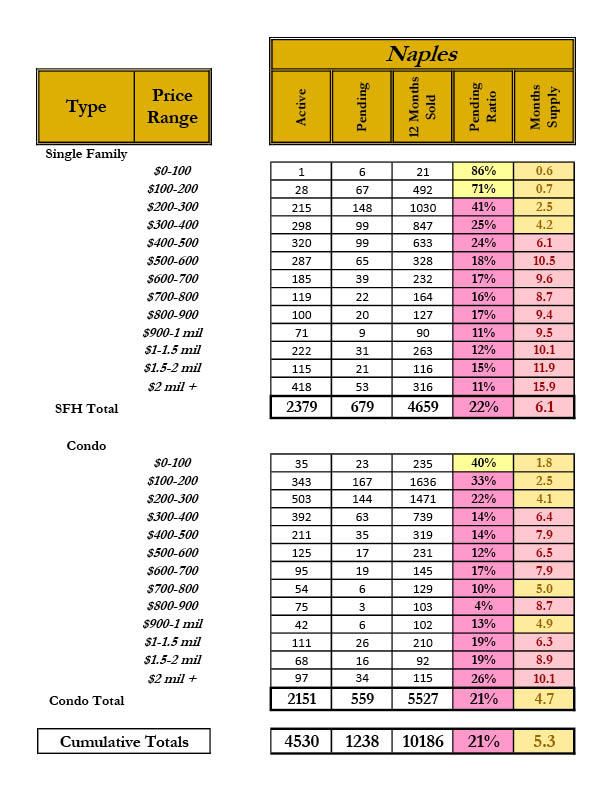

Naples

Single-family homes in Naples saw 2,379 active listings, 679 pending sales, 4,659 sales made in the past 12 months, a pending ratio of 22 percent, and a 6.1 month’s supply of inventory. For condominiums in Naples, there were 2,151 active listings, 559 pending sales, 5,527 sales made in the past 12 months, a pending ratio of 21 percent, and 4.7 month’s supply of inventory. Adding up the total figures for Naples, there were 4,530 active listings, 1,238 pending sales, 10,186 sales within the past 12 months, a pending ratio of 21 percent, and a 5.3 month’s supply of inventory. The overall pending ratio of 21 percent in the Naples market indicates the market was stable in 2015.

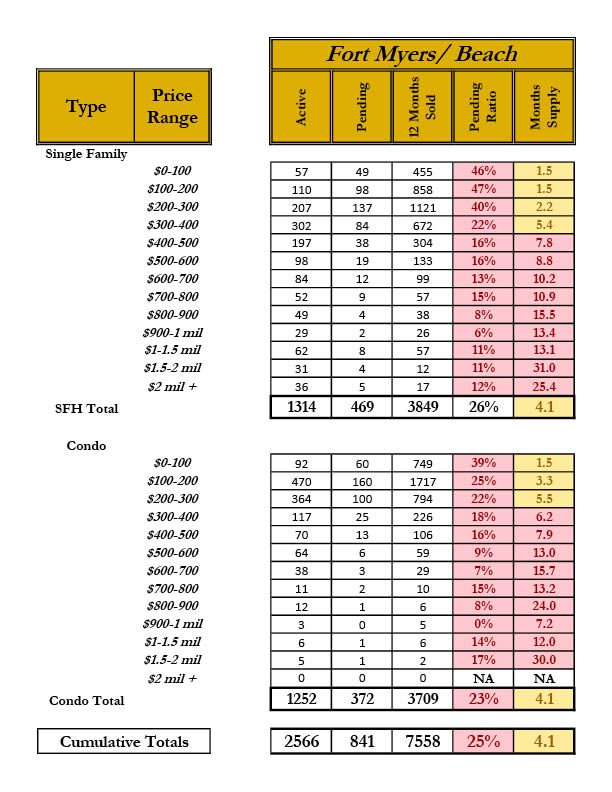

Fort Myers & the Beach

In Fort Myers/the Beach, the single-family home category had 1,314 active listings, 469 pending sales, and 3,849 sales over the past 12 months, a 26 percent pending ratio, and an inventory supply of 4.1 months. Condominiums in Fort Myers/the Beach saw 1,252 active listings, 372 pending sales, 3,709 sales made over the past 12 months, a 23 percent pending ratio, and an inventory supply of 4.1 months. Combining the figures for single-family homes and condominiums, Fort Myers/the Beach had 2,566 active listings, 841 pending sales, 7,558 sales made in the last 12 months, a 25 percent pending ratio, and an inventory supply of 4.1 months. Fort Myers/the Beach’s overall pending ratio of 25 percent and a month’s supply of less than 5 months indicates a seller’s market and increased prices in 2015.

Across the board, the higher priced segments are seeing a higher month’s supply than lower priced segments, thus correlating with 2015 brisk sales of units priced under $400K. Also, the longer month’s supply shows it was most likely a buyer’s market within the higher priced luxury home segment, but with stable sales. The Naples market saw the longest average month’s supply in 2015, while Fort Myers/the Beach saw the lowest. Bonita Springs and Naples remained in the stable market zone in 2015 for both sellers and buyers, while Estero and Fort Myers/the Beach showed less stability in the seller’s favor for 2015 overall.

It’s critical your real estate agent understands how to look at absorption rates so he or she can provide you most up-to-date information which will formulate an accurate selling strategy for your listed home in Southwest Florida.

By D. Michael Burke, P.A.

Keller Williams Elite Realty